13 – 08 – 2025

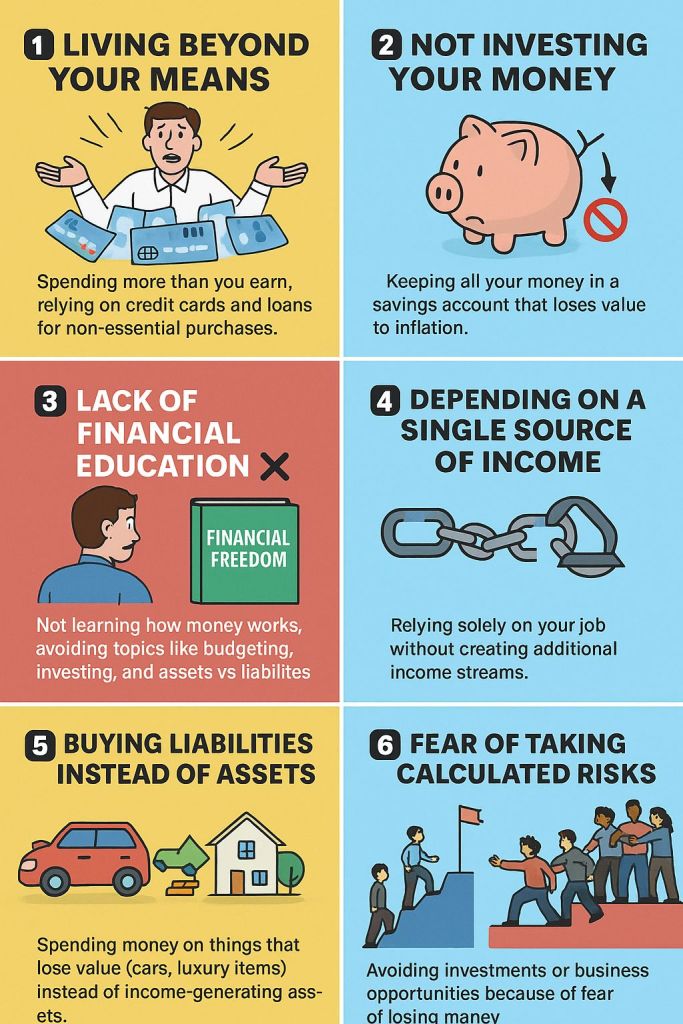

### **1️⃣ Living Beyond Your Means 💳💥**

**Mistake:** Spending more than you earn, relying on credit cards and loans for non-essential purchases.

**Why It Keeps You Poor:** Debt eats your income through high interest rates, preventing you from building savings or investing.

**Image idea:** Person drowning in credit card bills.

**Emoji:** 💳💸⛔

**Hashtags:** #DebtTrap #LiveBelowYourMeans #FinancialDiscipline

—

### **2️⃣ Not Investing Your Money 📉🚫**

**Mistake:** Keeping all your money in a savings account that loses value to inflation.

**Why It Keeps You Poor:** Inflation decreases your purchasing power over time; without investments, your wealth never grows.

**Image idea:** Piggy bank shrinking in size.

**Emoji:** 📉🐷💔

**Hashtags:** #StartInvesting #MoneyGrowth #BeatInflation

—

### **3️⃣ Lack of Financial Education 📚❌**

**Mistake:** Not learning how money works, avoiding topics like budgeting, investing, and assets vs liabilities.

**Why It Keeps You Poor:** Without financial knowledge, you can’t make smart decisions to grow your wealth.

**Image idea:** Person ignoring a book titled “Financial Freedom.”

**Emoji:** 📚🚫💡

**Hashtags:** #MoneyEducation #FinancialFreedom #WealthMindset

—

### **4️⃣ Depending on a Single Source of Income 💼🔗**

**Mistake:** Relying solely on your job without creating additional income streams.

**Why It Keeps You Poor:** If you lose your job or your salary is stagnant, your financial stability collapses.

**Image idea:** One broken chain link representing lost income.

**Emoji:** 💼⚠️🔗

**Hashtags:** #MultipleStreamsOfIncome #SideHustle #FinancialSecurity

—

### **5️⃣ Buying Liabilities Instead of Assets 🚗💎**

**Mistake:** Spending money on things that lose value (cars, luxury items) instead of income-generating assets.

**Why It Keeps You Poor:** Assets put money in your pocket, liabilities take it out.

**Image idea:** Car losing value vs property gaining value.

**Emoji:** 🚗📉🏠📈

**Hashtags:** #BuyAssets #RichDadPoorDad #MoneySmart

—

### **6️⃣ Fear of Taking Calculated Risks 😨📉**

**Mistake:** Avoiding investments or business opportunities because of fear of losing money.

**Why It Keeps You Poor:** Playing too safe means your money never grows, and you miss opportunities to build wealth.

**Image idea:** Person watching others climb while staying at the bottom.

**Emoji:** ⚖️🚀💡

**Hashtags:** #CalculatedRisk #FinancialGrowth #WealthOpportunities

—

### **7️⃣ Surrounding Yourself with the Wrong People 🚫👥**

**Mistake:** Spending time with people who have poor money habits and no ambition.

**Why It Keeps You Poor:** Your environment influences your mindset—negative surroundings limit your growth.

**Image idea:** Group pulling someone down while others climb to success.

**Emoji:** 👥🚫📉

**Hashtags:** #PositiveVibesOnly #WealthCircle #MindsetMatters

—

### **💡 Final Message**

💬 *”Wealth is not just about money—it’s about mindset, discipline, and the choices you make every day. Change your habits, change your future!”* 🚀💰